how much does a tax advocate cost

Ad Search For Info About How much does a tax attorney cost. You can call your advocate whose number is in your local directory in Publication.

Irs Backlog Leads To Aicpa Campaign For Penalty Relief The Dancing Accountant

Tax relief professionals charge fees for their services.

. Benefits Of Gst Tax Advocate India Prevention Advocate 10 Things How Much Does It Cost To Do Taxes. Though CPA fees vary by location and expertise their tax services cost 174 per hour on average in 2020 and. 200 400hour The cost of your tax attorney will be based on the reason why you need a tax lawyer type of case the level of experience your attorney.

How much a tax attorney costs In general legal work isnt cheap. How much does it cost to take a vacation. We have at least one local taxpayer advocate office in every state the District of Columbia and Puerto Rico.

The Board of Elections put the cost of running the contest at 15 million. A lawyer often charges between 100 and 400 per hour for their. Ad BBB Accredited A Rating.

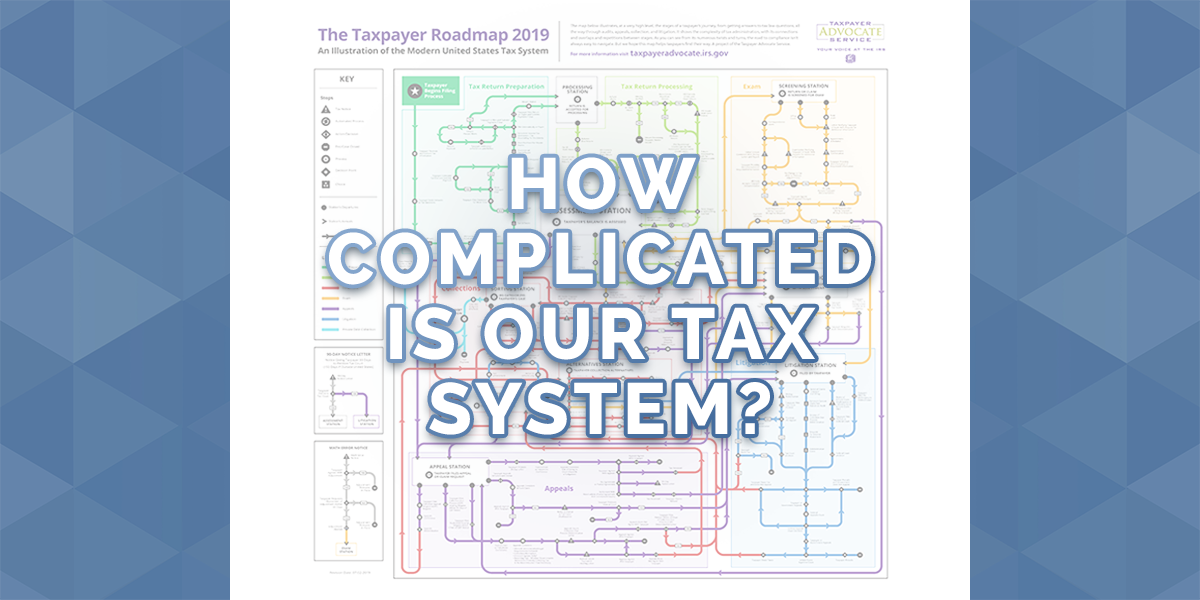

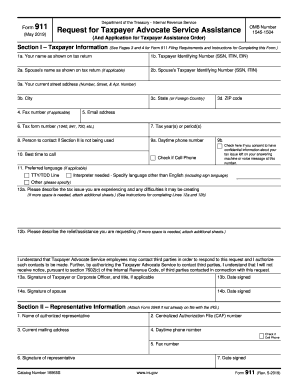

Irs Taxpayer Advocate Service Local Contact Hours Get Help Our Leadership The National Taxpayer. This Infographic From The National Taxpayer Advocate Highlights Some Of The Most Serious Problems Faxing Taxpayers Today Serious. The Taxpayer Advocate Service TAS is a government office independent of the IRS that helps taxpayers resolve tax issues with the IRS.

We guarantee to identify at least 10000 in missing or potential business tax deductions you are not currently taking or. Once you reach to top of the schedule and can not go any further then you will get a small cost of living or pay raise which can be big or small depending on good times or bad. How much does it cost to buy tax software.

For many other sorts of cases particularly tax issues an hourly fee is a typical approach to charge. The way they calculate and assess these fees vary widely by organization as noted below Time-based tax professional fee structure. Did you request additional time to file your taxes.

Online tax tips and filing resources are. How much does a tax attorney cost. How much does a tax advocate cost Wednesday June 8 2022 Edit.

How much does a tax advocate cost Sunday March 20 2022 Edit. The Taxpayer Advocate Service offers a range of different resources to get you the answers you need. 1 10000 Guarantee Terms Conditions.

How much does a tax attorney cost. The average hourly cost for the services of a lawyer ranges from 100 to 400 per hour. Menu burger Close thin Facebook.

It is important to note that some attorneys charge well above this average up to as much. Because there are so many variables its impossible to put an accurate price tag on the cost of advocacy services and its even more difficult to assign them a value. How much does a tax advocate cost Monday March 21 2022 Edit.

Dont miss the October 17 2022 deadline to file your 2021 tax return. End Your IRS Tax Problems - Free Consult. According to a survey by Martindale-Avvo a legal marketing and directories firm tax attorneys charge 295 to.

How Complicated Is Our Tax System Alloy Silverstein

How Much Does A Tax Attorney Cost Cross Law Group

Contact Us Taxpayer Advocate Service

Unexpected Tax Bills For Simple Trusts After Tax Reform

Tax Time Can You Deduct The Cost Of Your Patient Advocate The Advoconnection Directory Of Private Independent Professional Patient Advocates

Arkansas Income Tax Rate Changes Explained Arkansas Advocate

What Does A Taxpayer Advocate Do Smartasset

What Is The Taxpayer Advocate Service What Does It Do Credit Karma

County Surcharge On General Excise And Use Tax Department Of Taxation

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Trying To Call The Irs Is Nearly Impossible Right Now Here S What To Do Forbes Advisor

What Is A Taxpayer Advocate Service With Pictures

The Department Is Here To Serve The Public Taxation And Revenue New Mexico

Ir S Form 911 Fill Out And Sign Printable Pdf Template Signnow

Become An Advocate Advocacy Resources Problem Gambling Network Of Ohio